Credit Management

CRM01

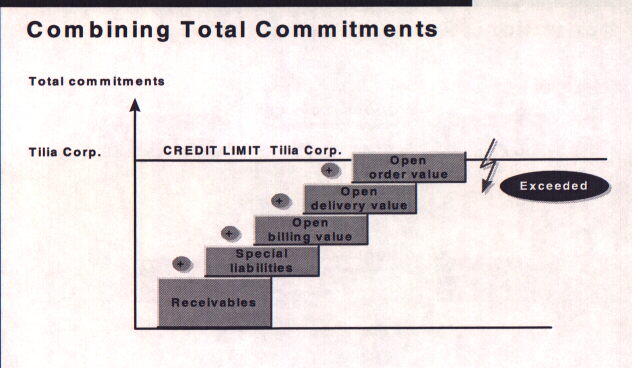

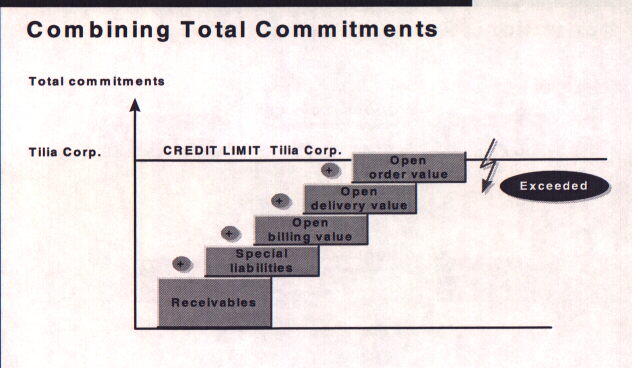

· Open order value

The open order value is the value of all order items which have not yet been

delivered.

The open order value is based on confirmed quantifies (Confirmed quantities

x Credit price = Open order value of an order). An order which has been blocked

due to a credit check does not contain confirmed quantities. The open order

value does not increase as long as the block remains in place.

· Open delivery value

The open delivery value is the value of all delivery items which have not

yet been billed.

· Open billing value

The open billing value is the value of all billing items which have not yet

been transferred to Accounting.

· Receivables from sales are included in total commitments as long as

they have not been indicated as disputed items. For more information, see the

chapter on processing incoming payments and commitments.

· Receivables from special G/L transactions are transferred from

special commitments to total commitments if they are relevant to credit limit,

for example payments. For more information, see the chapter on processing

incoming payments and commitments.

The system updates values based on the payer.

CRM02

CRM03

CRM04

CRM05

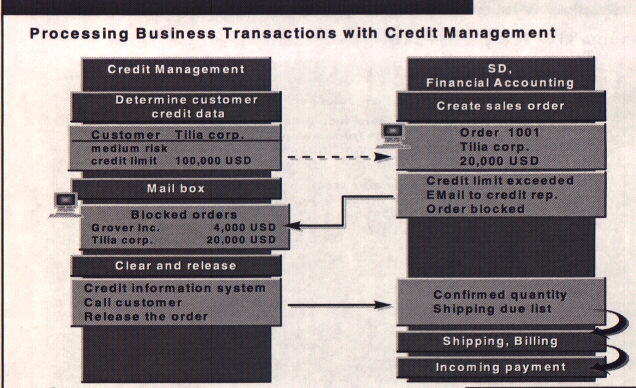

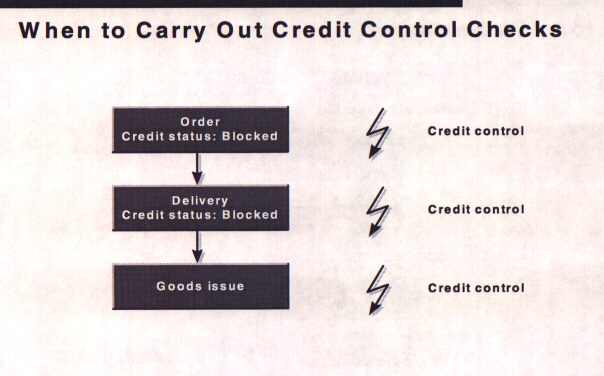

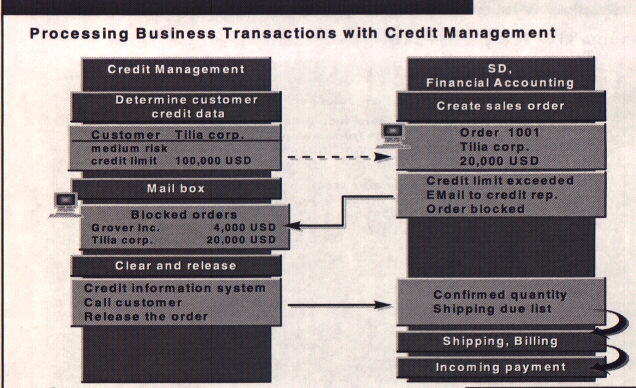

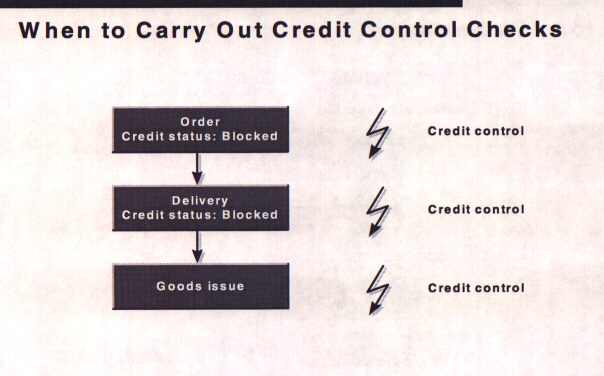

- Use the system settings to specify when you would like to carry out a

credit control check. You could require that checks be carried out only during

sales order processing.

- Subsequent function in Sales and Shipping cannot be carried out as long as

the relevant document is blocked by a credit check.

- A check carried out at goods issue can no longer block the transaction as

goods issue is the final function in Shipping. If a credit check is carried

during goods issue and the transaction exceeds the credit limit, it is not

posted for delivery. The system issues an error message.

CRM06

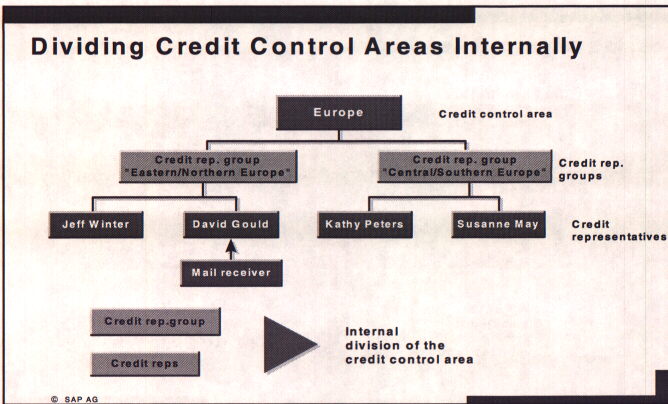

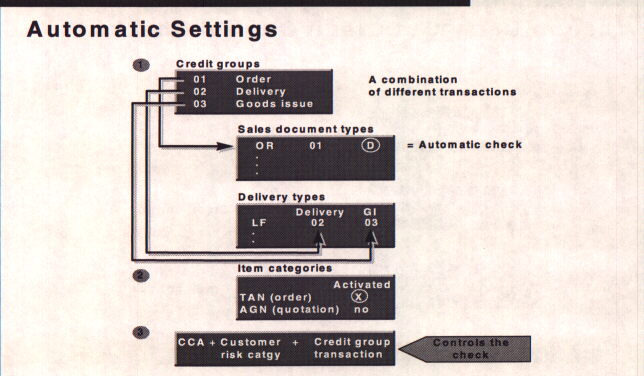

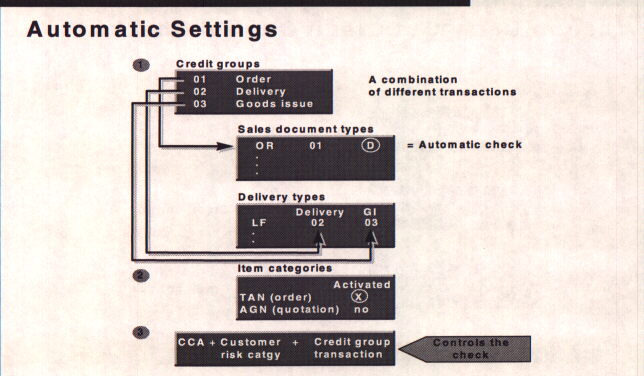

The credit control area, the risk category of the customer and the business

transaction all influence the type and scope of automatic credit checking.

Credit groups combine different business processes that are to be treated in

the same way with regards to the credit check. These credit groups are assigned

to the sales document types and the delivery document types for which a credit

limit check is to be carried out.

You determine for each item category, whether an item of that item category

is included in the credit functions. The credit management field must be

activated for item categories that are to be taken into account during the

credit check.

CRM07

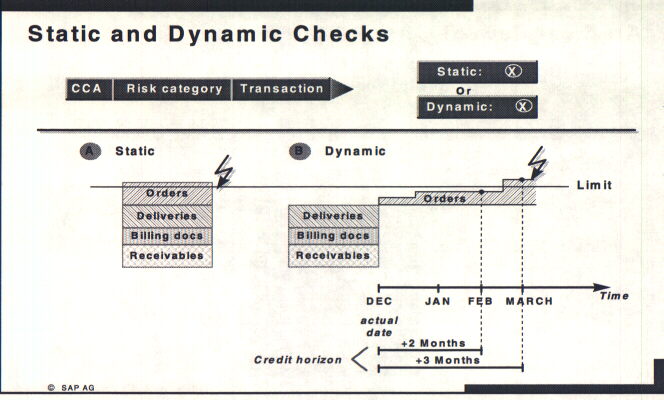

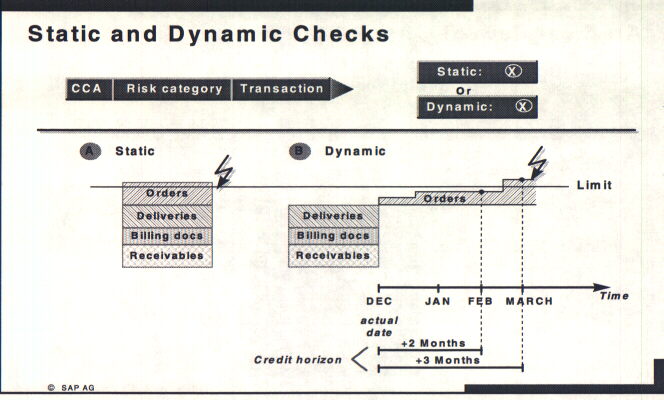

- The customer credit exposure can be divided into a static part (open items,

open billing values and delivery values) and a dynamic part (open order value).

- The open order value comprises all partially delivered or undelivered

orders. It is accumulated for the material availability date within an

information structure in freely definable units of time or periods, ( day, week,

month).

- When defining the credit check, you specify a certain number of the

corresponding periods from which the date will be determined in the future.

- This makes sure that sales orders planned in the future are not taken into

account when determining credit exposure.

- The 'actual date' in this example is the initial date for determining the

open order value on the credit horizon. The 'actual date' is the current date

for each check. In an order, it is the date that the order is created or

changed. In a delivery, it is the date that the delivery is created or changed.

CRM08

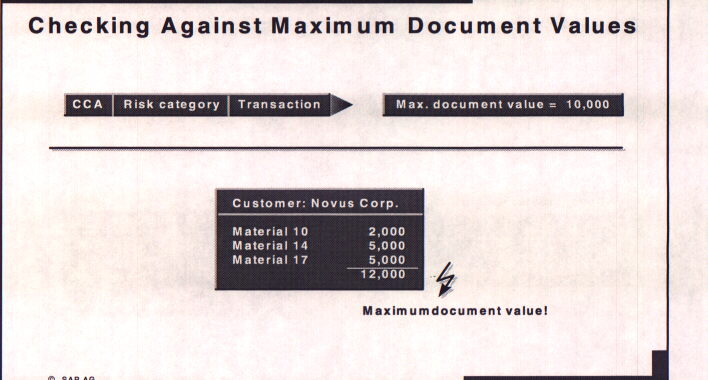

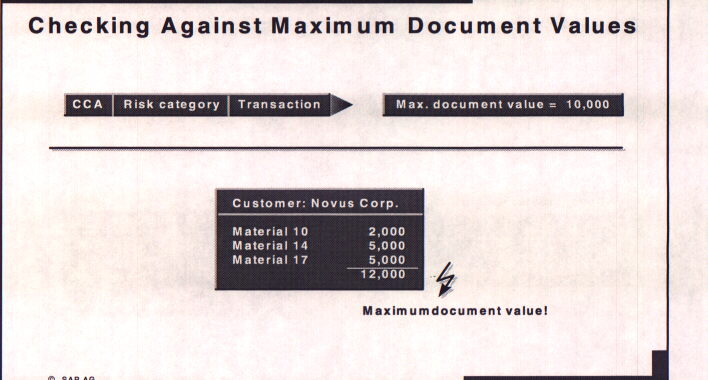

- The sales order or delivery value may not exceed the specific value defined

in the credit check. This value is stored in the currency of the credit control

area. It is particularly applicable if a credit limit has not yet been defined

for a new customer. You can initiate this check using a risk category defined

for a new customer.

CRM09

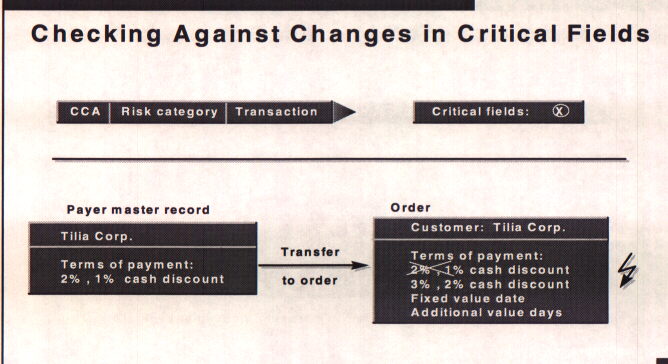

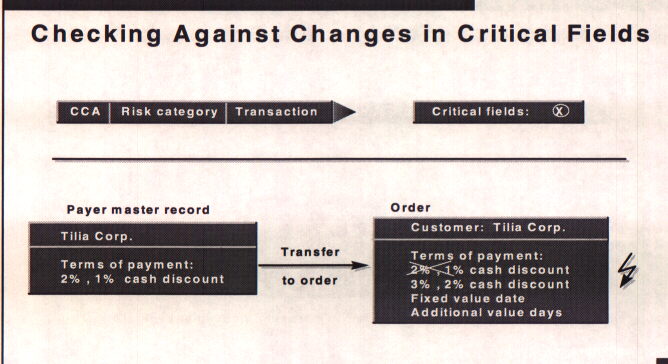

- When carrying out a check of this type, a credit check is triggered by

changes made in the document to values of any of the credit-sensitive fields.

These fields are proposed from the customer master record, and include, for

example, terms of payment and fixed value dates.

CRM10

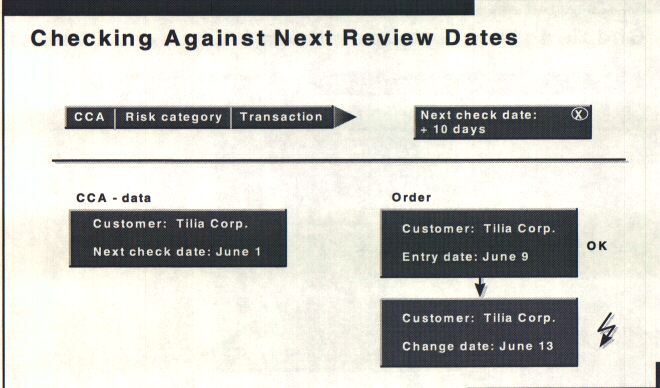

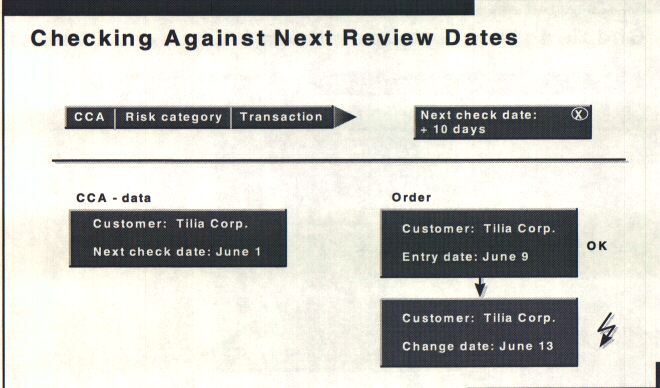

- Here you must specify a number of days. Without these 'buffer days' the

system will carry out the check as soon as it recognizes that the next check

date has been reached.

CRM11

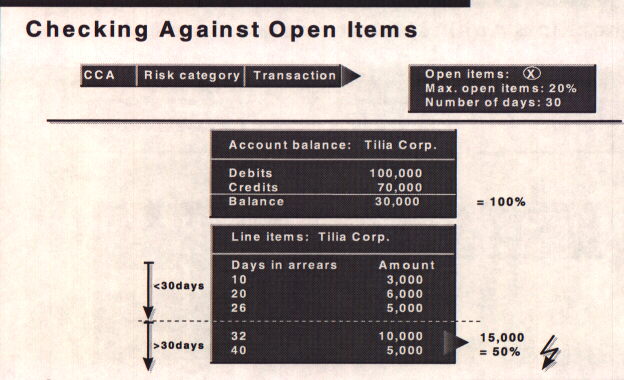

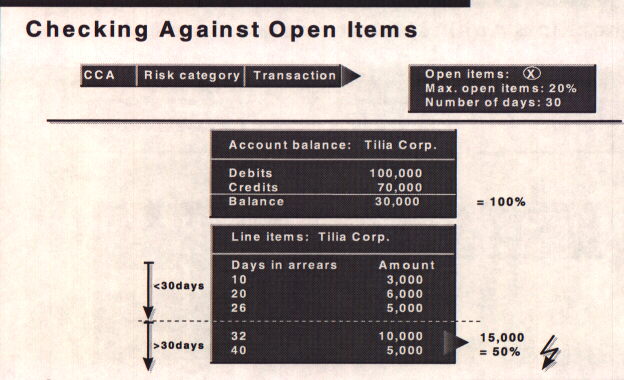

- The relationship between open items which are more than a certain number of

days overdue and the customer balance may not exceed a certain percentage.

CRM12

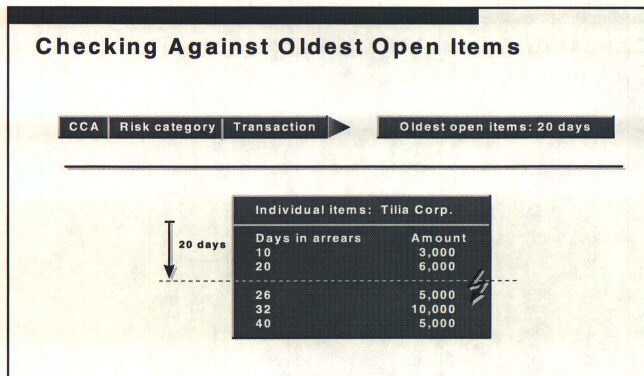

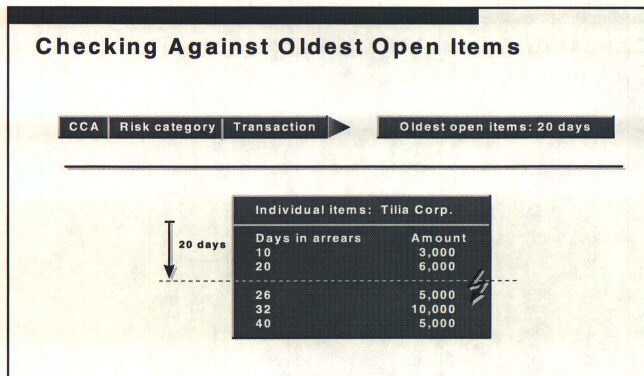

- By specifying the number of days, you can determine the days that oldest

open items may be in arrears.

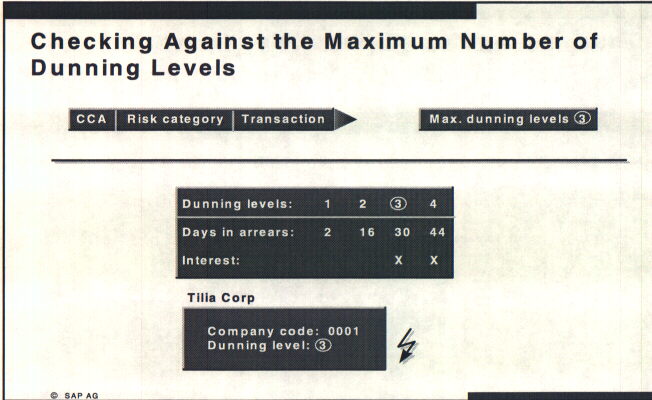

CRM13

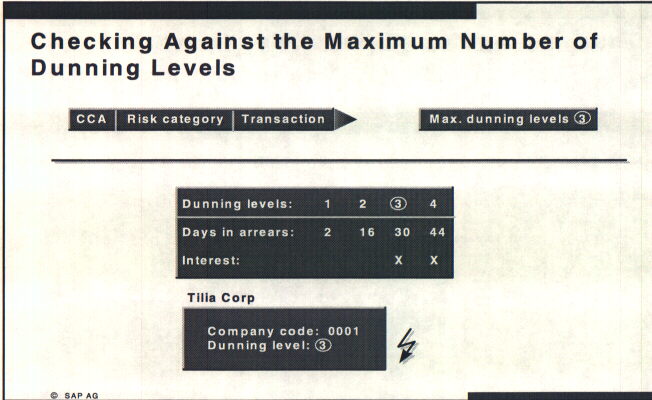

- Store the current dunning level in the customer master record with the

company code-specific data. If a customer reaches the dunning level, then the

order is blocked.